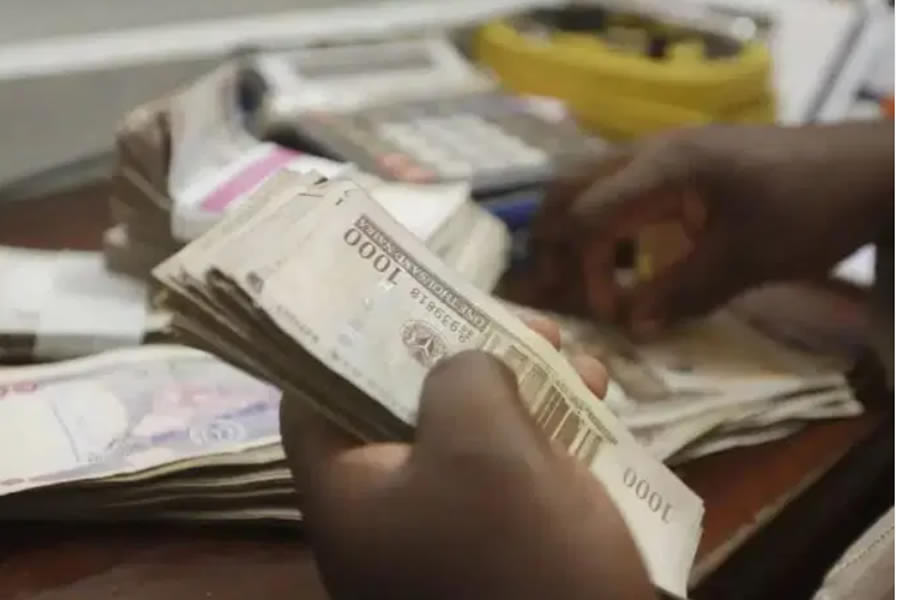

OPS Raises Concerns Over MSME Collapse Amid Cash Scarcity

The Organised Private Sector (OPS) has urged the Central Bank of Nigeria (CBN) to address the ongoing cash scarcity, warning that the country’s economic infrastructure is not yet ready for a fully cashless system.

The OPS emphasized that Micro, Small, and Medium Enterprises (MSMEs) have been severely impacted, raising fears of imminent collapse within this critical business sector.

Cashless Policies Disrupt Business Operations

Segun Kuti-George, National Vice President of the Nigerian Association of Small-Scale Industrialists, highlighted that while the CBN’s goal may have been to modernize the financial system, the unintended consequence has been a disruption of business operations.

- He explained that a significant part of Nigeria’s population relies heavily on cash for daily transactions.

- Kuti-George noted that even in developed nations, cash remains readily accessible, backed by efficient systems and financial literacy.

- In Canada, for instance, withdrawal limits can reach $1,500 per transaction, while Nigeria’s N20,000 limit (approximately $26) proves impractical for businesses.

He stressed the need for a balanced transition to cashless systems, combining financial inclusion, improved infrastructure, and policies that align with Nigeria’s economic realities.

MSMEs Face Survival Challenges

Dr. Femi Egbesola, President of the Association of Small Business Owners of Nigeria, echoed similar concerns, stating that the cash crunch disproportionately affects small businesses.

- Many businesses rely on cash to sell low-priced goods (N50 to N200).

- The cash scarcity has led some small business owners to buy cash from POS operators at inflated rates, which either reduces profits or forces price hikes.

- These challenges discourage small businesses from banking, reducing financial inclusion and increasing risks of cash-related insecurity.

Egbesola urged the CBN to act swiftly to avoid further damage to small businesses, warning that prolonged scarcity could lead to sector-wide collapse.

Cash Scarcity Slows Economic Activities

Dr. Muda Yusuf, Director of the Centre for Promotion of Private Enterprise, pointed out that cash scarcity slows the volume of transactions, particularly in Nigeria’s informal sector and rural areas.

- Urban areas increasingly adopt electronic payments, but rural economies remain cash-dependent.

- Disruption in cash flow hampers the payment system, reducing economic activity across the country.

Yusuf also addressed key challenges worsening the cash crisis, such as:

- Low financial inclusion, particularly in rural areas.

- Trust issues caused by failed online banking apps.

- Money laundering and corruption activities that heighten cash demand.

He further explained that the rise of POS operators has created new cash dynamics, with over three million POS businesses competing with banks for cash flow.

CBN’s Actions to Address Cash Scarcity

In response to the crisis, the Central Bank of Nigeria has introduced measures to curb the illegal flow of mint naira notes and improve cash availability:

- A N150m fine per branch will be imposed on banks found guilty of diverting cash to currency hawkers.

- Spot checks, mystery shopping, and other enforcement strategies will ensure compliance with cash distribution policies.

- Repeat offenders will face stricter penalties under the Banks and Other Financial Institutions Act 2020.

The CBN also warned against cash hoarding, emphasizing that these practices violate its Clean Note Policy and hinder efficient cash flow.

Stakeholders Call for Inclusive Policies

Adewale-Smatt Oyerinde, Director-General of the Nigeria Employers’ Consultative Association, described the cash scarcity as a double-edged sword:

- While it may accelerate the shift to a cashless economy, it poses serious risks to MSMEs and informal businesses that rely on cash for survival.

- Oyerinde called for policies that balance digital transformation with economic inclusivity.

Dele Oye, President of the Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture, highlighted the lack of confidence in the naira as a contributing factor to cash scarcity.

- He noted that many Nigerians hold dollars instead of naira, underscoring the need for the CBN to stabilize the currency and engage stakeholders for transparency.

Key Takeaways

- MSMEs and the informal sector face severe disruptions due to cash scarcity.

- Stakeholders urge a balanced transition to a cashless economy with improved financial infrastructure.

- The CBN has introduced fines and monitoring measures to curb illegal cash practices.

- Addressing financial inclusion, infrastructure, and public confidence remains critical for Nigeria’s economic stability.

Conclusion

The lingering cash scarcity in Nigeria has created significant challenges for businesses, particularly MSMEs and the informal sector. While policies promoting cashless transactions are commendable, a gradual approach that prioritizes financial inclusion, trust, and infrastructure improvement is essential. Collaborative efforts from the CBN and stakeholders are needed to stabilize the economy and prevent further disruption.