The Corporate Affairs Commission has released new rules to help Deposit Money Banks with the current recapitalization process.

. The commission has officially announced a new directive through a statement signed by its management and published on its Facebook page last Friday. This directive falls within our jurisdiction as stated in Section 8 (1) (e) of the Companies and Allied Matters Act No. 3 of 2020.

It urged banks to immediately adhere to the policy.

It stated that the new guidelines were issued to guide proper filing for new incorporations, increase in share capitals, mergers and upgrade or downgrade of licence authorisation.

For new incorporations, the CAC stated that intending applicants must submit requirements, including “an approved name reservation or availability, approval-in-principle from sector regulator, duly completed on-line incorporation form and payment of stamp duty and filing fees for the category of license authorisation.”

It added that a certificate of incorporation will be issued within 24 hours for applications that satisfy all requirements for incorporation of companies prescribed in the commission’s operations checklists available at www.cac.gov.ng/resources.

Also, it noted that banking institutions seeking to increase their share capital through private placements, rights issues and/or offers for a subscription must submit a duly signed company resolution, return of allotment and other statutory declaration by directors verifying that the issued share capital is fully paid- up

“Notice of the fact that regulatory approval is required, an affidavit deposed to by a director of the company to the effect that regulatory approval is required for the increase, an amended memorandum of association reflecting the new share capital.

“Payment of stamp duties and filing fees, Issuance of a letter acknowledging notice of increase and requirement of regulatory approval, filing of regulatory approval and the issuance of a certificate of increase,” it added.

According to the commission, under the category, the notice of the fact that regulatory approval is required must be filed following the provisions of Section 127 (3), (4) & (5) of CAMA

“Annual returns and information on persons with significant control must be filed up-to-date and certificate of the increase shall be issued within 24 hours of filing of regulatory approval,” it stated.

It noted that small and medium banking institutions seeking to merge must submit duly signed special resolutions for merger by each of the merging companies.

According to CAC, other requirements are the scheme of merger duly approved by the Securities and Exchange Commission

“A certified true copy of the court order authorising extraordinary general meeting of each of the merging companies. Evidence of publication of Court-ordered meeting in two Newspapers and the Federal Gazette and a CTC of Court order sanctioning the scheme of merger.”

“All enquiries and complaints on these Guidelines and applications submitted in pursuance of the recapitalization exercise should be addressed to bankrecapitalization@cac.gov.ng or call +234 816 920 9551,” the statement added.

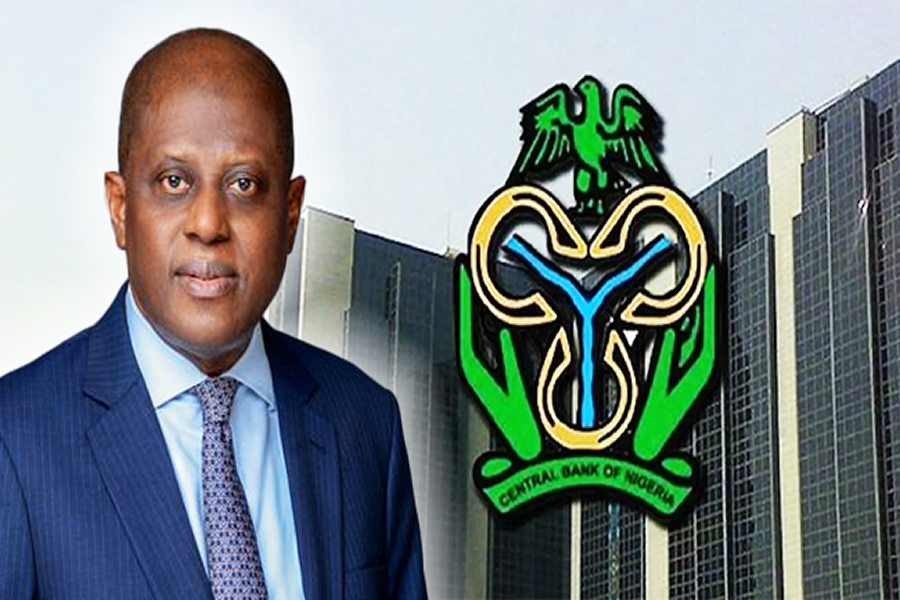

Recall that the Central Bank of Nigeria in March 2024 directed all banks to increase their capital base for improved productivity.

The apex bank had directed commercial banks with international authorisation to increase their capital base to N500bn and national banks to N200bn.

It also said commercial banks with national licences must meet an N200bn threshold, while those with regional authorisation are expected to achieve an N50bn capital floor.

This process has commenced with banks issuing public offers and rights issues to meet the two-year target.