Given Nigeria’s economic hurdles, including a high inflation rate, volatile currency, and rising living costs, survival strategies for when expenses exceed income are essential. Here are some practical approaches to help Nigerians cope in this challenging environment:

1. Prioritize Essential Expenses

- Focus on critical needs, such as food, shelter, healthcare, and education. Identify non-essential items to cut back on, such as luxury goods, subscriptions, or dining out. Prioritizing can help manage cash flow and reduce unnecessary financial strain.

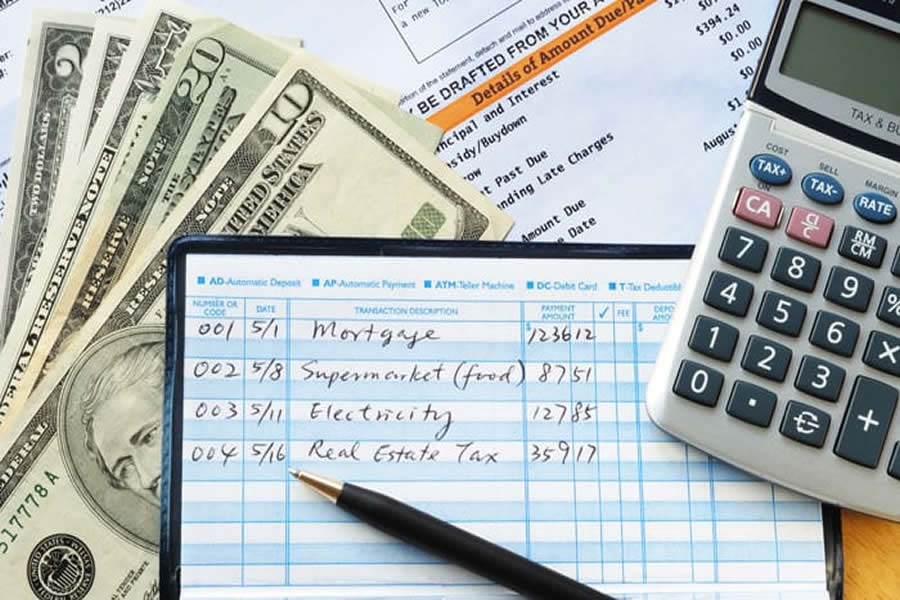

2. Create and Stick to a Budget

- Drafting a strict budget allows individuals to track income and expenditure, ensuring every naira is used purposefully. This practice can highlight areas where savings are possible and prevent overspending.

3. Embrace Bulk Buying and Cooperative Buying

- Purchasing non-perishable goods in bulk is often more economical and helps mitigate future price hikes. Joining cooperatives allows individuals to buy goods in bulk at a reduced rate, especially for essential items like rice, oil, and soap.

4. Adopt Multiple Income Streams

- With a challenging job market, side businesses, freelancing, and part-time work can provide additional income. Nigerians may explore income-generating skills such as tailoring, tutoring, driving (rideshare services), and digital freelancing in areas like writing or graphic design.

5. Use Affordable Transportation Options

- Rising fuel prices make transportation costs a significant burden. Consider alternative transportation modes such as walking or using public transport over more expensive private or commercial vehicles.

6. Leverage Local Produce and Seasonal Goods

- With food prices on the rise, buying local and in-season foods is often cheaper. Opting for fresh, locally sourced food items can lower costs compared to imported goods.

7. Use Mobile Apps for Financial Management and Savings

- Many mobile apps offer budget-tracking, goal-setting, and expense-management tools, helping to monitor spending and create savings plans, even for those with limited budgets.

8. Consider Cooperative Societies and Thrift Groups

- Thrift groups or “ajo” and cooperatives provide access to pooled funds and low-interest loans, offering a financial buffer during tough times. Such arrangements can ease pressure on household finances by offering flexible payback terms.

9. Explore Barter or Exchange Systems

- Where feasible, barter can provide access to goods or services without cash. Skills exchanges, community support, and resource-sharing are becoming valuable resources for those facing income shortfalls.

10. Stay Informed and Adapt

- Keeping abreast of economic policies, exchange rates, and inflation forecasts allows individuals to adapt quickly to changes. Understanding market trends can help make informed purchasing decisions and anticipate future expenses.

Survival in Nigeria’s current economic climate requires adaptive strategies, resourcefulness, and community support. By prioritizing spending, exploring additional income avenues, and taking advantage of cost-saving resources, individuals can better manage the financial squeeze.

Nigeria’s economic landscape has grown increasingly difficult, as inflation continues to soar and poverty deepens across the country. Several key factors are driving these challenges:

1. Rising Inflation and Cost of Living

- Over the last year, inflation in Nigeria has surged steadily, reaching a peak in June 2024 at 34.19% before showing a slight decrease to 32.70% in September. This steady inflation climb is largely attributed to the removal of fuel subsidies, depreciation of the naira, and escalating costs in transportation, food, and energy. These factors have significantly affected both the production and cost of goods, making daily necessities harder for Nigerians to afford.

2. Increasing Poverty Rates

- According to a recent World Bank Nigeria Development Update report, over 129 million Nigerians now live below the poverty line, representing a drastic increase from 40.1% in 2018 to 56% in 2024. With inflation outpacing economic growth and real GDP per capita yet to recover to pre-2016 recession levels, more Nigerians are falling into poverty. The surge in poverty rates illustrates the far-reaching effects of economic instability, particularly on middle- and lower-income groups.

3. The Strain on Household Budgets

- The cost of essentials like food and energy has risen dramatically. For instance, despite President Bola Tinubu’s promise to reduce petrol prices, his administration has overseen a 488% increase in petrol prices from N175 in May 2023 to N1,030 in October 2024. This increase has had a ripple effect across all sectors, further straining household budgets.

4. Economic Insecurity and Business Closures

- Many Nigerians have lost their sources of income, as small businesses struggle to survive in the harsh economic climate. Downsizing and layoffs have worsened unemployment rates, pushing more people into an oversaturated labor market. Entrepreneurs face significant hurdles, with operational costs often outweighing revenue, leading to widespread closures and further economic decline.

Implications for Nigerians

- The cumulative impact of these issues has led to heightened food insecurity and extreme hardship for millions of Nigerians. With basic items increasingly out of reach and fuel and energy prices skyrocketing, more families are being pushed into poverty daily. This economic environment requires urgent attention and strategic measures to provide relief and restore economic stability, particularly as the population grows and poverty deepens.

Strategies for Coping and Moving Forward

- Immediate Relief Programs: Subsidized food and essential goods, as well as targeted cash transfers, could help alleviate immediate hunger and hardship.

- Job Creation Initiatives: Programs focused on upskilling, particularly in digital and emerging sectors, could help Nigerians find alternative income sources.

- Economic Reforms: Fiscal policies aimed at stabilizing the naira and reducing dependency on imports may help contain inflation.

- Energy Alternatives: Investment in renewable energy could offer a longer-term solution to ease the burden of high petrol prices on households and businesses.

The economic trajectory shows that while Nigerians have continued to adapt, structural reforms, economic diversification, and targeted social support will be essential in addressing these systemic challenges.

Given the severe economic climate, here are some practical and sustainable survival strategies that can provide stability, security, and growth for individuals and families navigating rising expenses:

1. Budgeting and Prioritisation

- Create a detailed monthly budget focused on essentials, like rent, utilities, food, and children’s educational needs. Prioritize spending by distinguishing between “needs” and “wants” to ensure that limited funds are allocated effectively. Setting clear priorities helps you stay disciplined and avoid impulse purchases.

2. Expense Reduction

- Look for ways to cut down on non-essential spending, such as by cooking at home, using public transport, and buying in bulk from local markets. These small changes collectively result in significant savings. You may also consider switching to a more affordable school for your children or reducing entertainment subscriptions temporarily.

3. Income Diversification

- Multiple income streams provide a safety net. Explore side hustles, freelance opportunities, or weekend jobs that align with your skills and interests. Consider a small business you can run from home or engage in urban farming if space allows. If applicable, reselling unwanted items can bring in extra cash, and you might explore online platforms for additional work.

4. Assistance and Low-Interest Loans

- Don’t hesitate to seek financial assistance from family, friends, or charitable organizations for short-term relief. For longer-term financial needs, avoid high-interest loan apps and instead seek low-interest loans for essential investments like starting a small business. Local cooperatives and thrift societies can also be invaluable resources for pooled funding.

5. Lifestyle Adjustments

- Adjust family expectations and communicate the need for lifestyle changes. Reduce discretionary spending on non-essential items and discuss with your partner and children where expenses can be adjusted to meet current needs.

Long-Term Strategies

- Skill Development and Education

- Investing in affordable skills training or certifications can enhance your income potential. There are often scholarships, student loans, or low-cost educational programs available. Practical skills like cooking, tailoring, or plumbing can also offer immediate income opportunities and security.

- Entrepreneurship

- Starting a small business can provide additional income. Explore ventures that require minimal capital, such as home-based services or digital freelancing. Finding a reliable product or service that’s in demand locally can be a viable way to support your household income.

- Financial Literacy

- Educate yourself on budgeting, debt management, and investments. Apply the 50/30/20 rule: allocate 50% of income to essentials, 30% to discretionary spending, and 20% to savings or debt repayment. Knowledge in personal finance can lead to better money management and informed decisions.

Practical Tips

- Leverage Technology: Use apps for budgeting, discounts, and product comparisons to make the most of available deals.

- Join Cooperative Societies: Pool resources with others to access discounted goods and services or even small loans with favorable repayment terms.

- Support Local Businesses: Buy directly from local farmers or markets for cheaper goods and to strengthen the local economy.

- Take Advantage of Government Initiatives: Seek government relief options, such as subsidies, grants, or tax breaks, to ease financial burdens.

Through a mix of budgeting, income diversification, and prudent financial decisions, combined with skill development and local support networks, individuals and families in Nigeria can better withstand economic uncertainties and build resilience for the future.